SUPER SIX DRIVES SOLID EARNINGS SEASON

SOLID RESULTS AFTER A SLOW START

As we wrote in our January 16, 2024, Weekly Market Commentary, the bar was lowered heading into earnings reporting season, setting corporate America up for some solid upside. Specifically, fourth quarter earnings estimates for the S&P 500 were cut by 6.8% from September 30, 2023, through January 12. We also highlighted U.S. dollar weakness and healthy Korean export activity as indicators of potential upside.

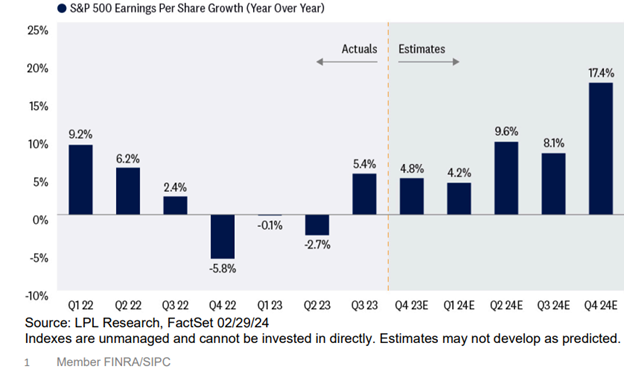

At the same time, however, mixed economic data, commodity price weakness, and challenges in the healthcare sector suggested upside might be capped. In the end, with just a handful of companies left to report, the S&P 500 delivered the 5% earnings growth and about five points of upside that we predicted. Strong results for mega cap technology and resilient profit margins helped offset the drag of special bank charges to replenish the FDIC deposit insurance fund.

S&P 500 DELIVERS SOLID MID-SINGLE-DIGIT EARNINGS GROWTH IN Q4

Earnings Growth Poised to Accelerate As 2024 Progresses

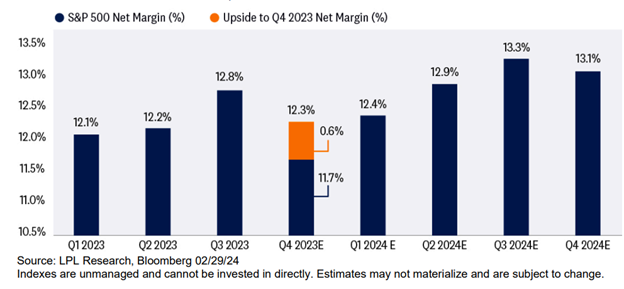

RESILIENT MARGINS A KEY COMPONENT OF THE UPSIDE

Part of our premise for the upside to earnings expectations was that analysts’ consensus was factoring in too much margin compression. When December year-end reporters started posting results, the consensus net margin estimate was calling for 110 basis points of compression. Instead, it looks like we’re going to get less than half that amount.

Some of that upside in margins came from revenue upside — the S&P 500 has reported 4.2% sales growth, a full percent above initial estimates. Some of the resilience reflects companies managing expectations, i.e., setting the bar low. Some was reflected in consumer inflation outpacing producer inflation, which is generally good for profit margins. But some of it also reflects companies’ ability to control costs and maintain pricing power in a disinflationary environment.

Consumers may increasingly push back on price increases in the quarters ahead, but for now, corporate America is doing an excellent job preserving margins, while demand from consumers and businesses has been strong enough to generate respectable sales gains.

NICE UPSIDE SURPRISE IN Q4 PROFIT MARGINS

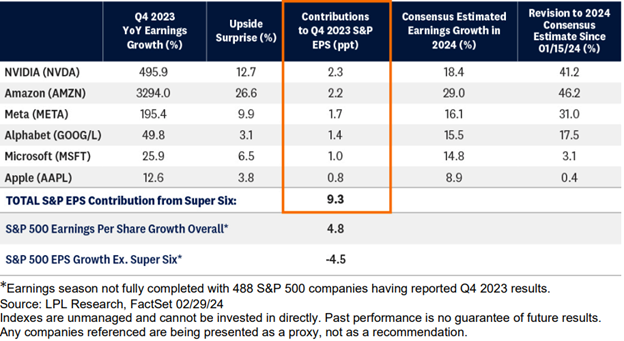

SUPER SIX PLAYED A BIG ROLE

We also wrote about the mega cap technology companies (usually referred to as the Magnificent Seven) in our earnings season preview in January, pointing out that results for this group would be a key factor in determining whether S&P 500 companies could deliver attractive earnings upside. Well, that comment proved prescient because this group delivered on lofty expectations and then some.

The numbers speak for themselves. Removing Tesla, which experienced a drop in earnings in the fourth quarter, the Super Six drove more than nine percentage points of earnings contribution for the S&P 500. More specifically, S&P 500 earnings per share would have declined 4.5% in the quarter if not for these six companies. Add them in and that decline becomes a 4.8% increase.

If that wasn’t impressive enough, expectations for 2024 results for this group were lifted significantly. While Apple’s and Microsoft’s consensus EPS estimates for this year increased modestly, the top four saw increases of between 17.5% and 46.2%. And these aren’t small companies, with S&P 500 weightings of 3.7% (NVDA), 3.4% (GOOG/L), 3.3% (AMZN), and 2.2% (META). So not only did this group grow earnings significantly last quarter, but their already very strong outlooks were strengthened further by a healthy dose of management optimism.

HUGE EARNINGS CONTRIBUTION FROM “SUPER SIX” IN Q4

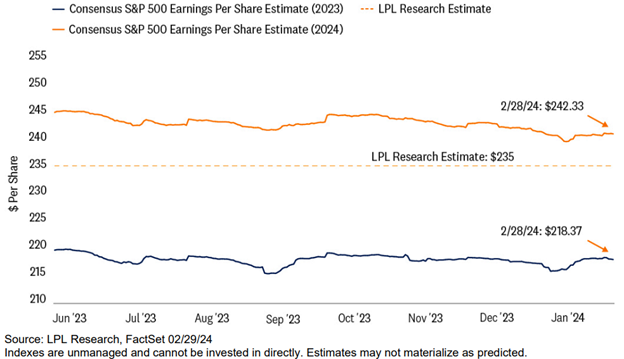

WHAT TO DO WITH 2024 FORECASTS

The strong earnings season and resilience of estimates increase the chances that LPL Research’s forecast for S&P 500 EPS in 2024 at $235 is too low. Also consider we increased our forecast for U.S. economic growth this year, from 1% to 1.4% (based on gross domestic product). Moreover, artificial intelligence tailwinds remain firmly in place, last year’s healthcare and natural resources earnings declines are poised to reverse, cost pressures continue to ease, and companies have maintained a fair amount of pricing power.

On the flip side, the U.S. economy is poised to slow some this year. Our outlook for European economic growth is lackluster, and China’s economy faces significant headwinds and may not, in reality, even come close to the Bloomberg consensus GDP growth forecast of 4.6% for 2024. Add to that, we don’t have a lot of conviction in a weak U.S. dollar view, a wildcard for earnings, and it’s only early March. Bottom line, we’ll hold our estimate where it is for now while acknowledging both greater confidence that $235 can be achieved and an upward bias.

ESTIMATES HAVE HELD UP VERY WELL DURING EARNINGS SEASON

CONCLUSION

Fourth quarter earnings season delivered as we had hoped. Not only did corporate America deliver solid upside to estimates, overcoming some big bank charges, but guidance was strong enough to keep estimates from falling much at all. That raises the 2023 base and shores up confidence for 2024. The current LPL Research estimate is calling for about 7.5% earnings growth from the S&P 500 this year, slightly below the long-term average despite relatively easy comparisons following lackluster earnings growth of about 2% during a challenging 2023.

Strong results were needed to help justify rich valuations, and corporate America came through. If companies can deliver near-consensus earnings estimates in 2024, buoyed by big tech, and the Federal Reserve can engineer a soft landing as inflation continues to gradually ease, then we believe stocks stand a good chance of not only adding to year-to-date gains through year-end, but also keeping the price-to-earnings ratio (P/E) around 20, which we view as fair based on LPL Research’s macroeconomic outlook.

ASSET ALLOCATION INSIGHTS

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral equities stance despite the strength of the latest stock market rally that has carried the S&P 500 over the 5,000 milestone. The improved outlook for economic growth and earnings, along with relative stability in interest rates, keeps the risk-reward trade-off for stocks and bonds fairly well balanced still, though upside over the rest of the year is likely to be modest.

Within equities, the STAAC continues to favor a tilt toward domestic over international equities, with a preference for Japan among developed markets, and an underweight position in emerging markets (EM). The Committee also recommends a slight tilt toward large caps and growth stocks. Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.